Hot News

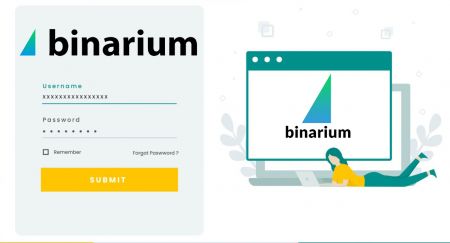

Welcome to the Binarium Broker website. You are now on the registration page with Binarium trading broker. Binarium platform has been on the trading market since 2012 and has more than 50 thousand traders around the world. The advantage of the broker is that it accepts traders from all countries except the USA, Canada, and Israel. Also in the review, you can read that you can start trading with a minimum deposit of $5 and a minimum bet $1 or equivalent in the account currency.